Invest Smart Toolbox

Multiply Your Magic Challenge

Become More

legendary

in just 28 days!

What Champion Unicorn can teach you about Multiply Your Magic!

Passive Investor Guide

This guide is built to help you understand what it really means to invest in multifamily syndications and what to expect as a limited partner. Inside, you’ll learn:

Why multifamily remains a resilient asset class across market cycles

How syndications are structured and how passive investors get paid

The difference between sponsor marketing and actual investor communication

What alignment looks like between sponsors and investors

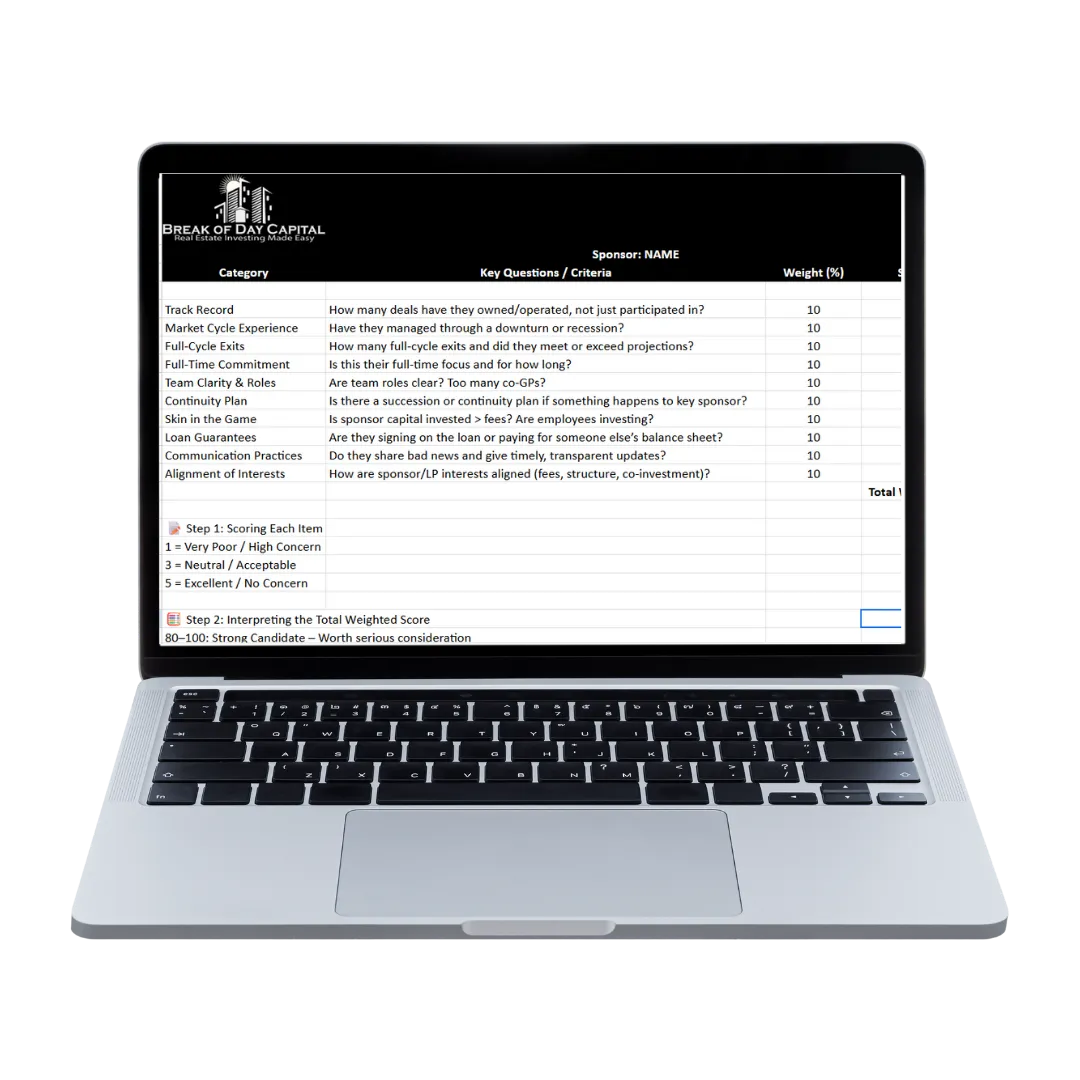

Invest smart Vetting Tool

The Invest Smart Vetting Tool provides you with a clear, repeatable process for evaluating multifamily sponsors and deals. Inside, you’ll discover:

How to spot unrealistic projections and aggressive assumptions

The key red flags in sponsor structures and incentives

What true alignment of interests looks like

Why conservative underwriting and proven operations matter more than sales pitches

A step-by-step framework to compare opportunities with confidence

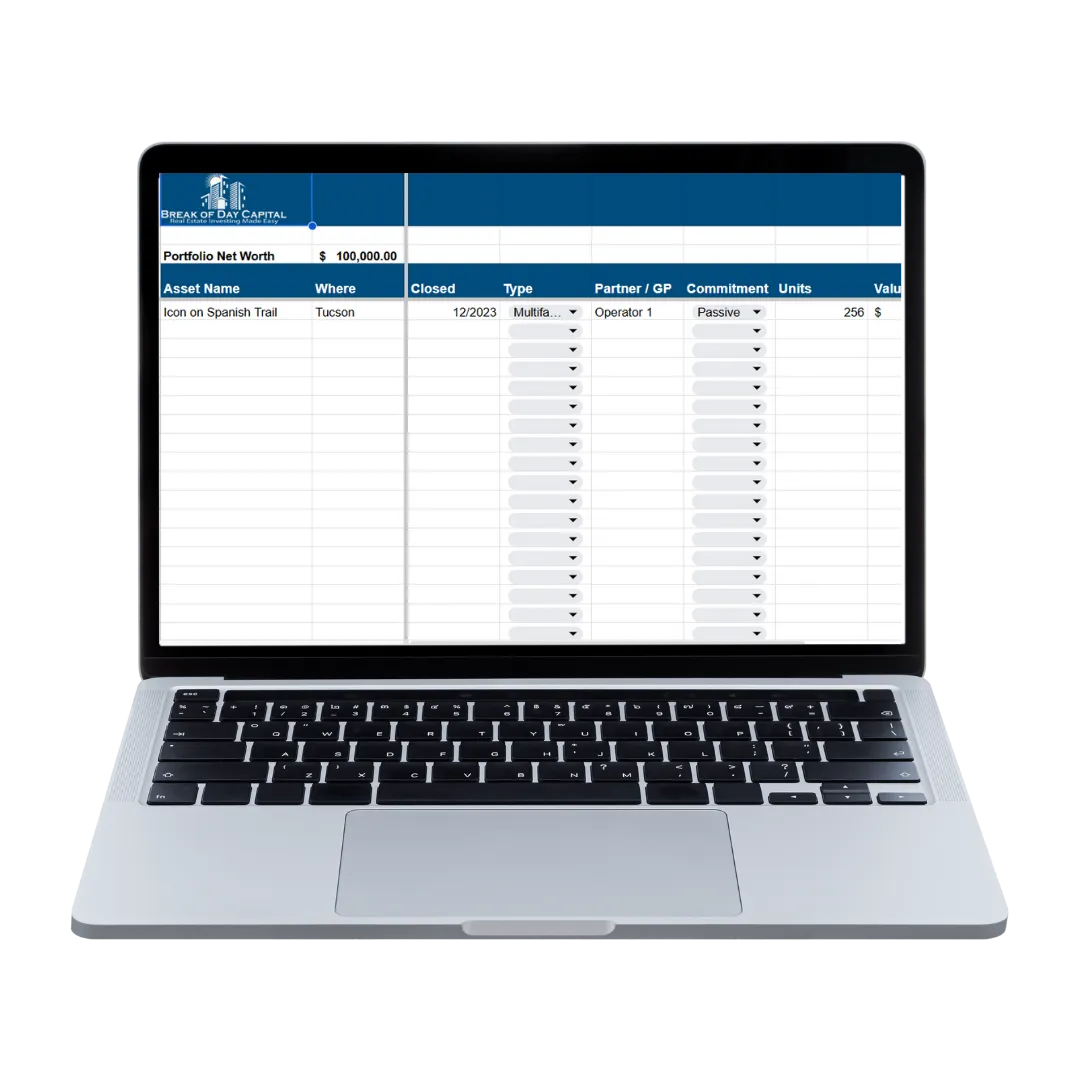

Portfolio tracker

This tracker is designed to give you a clear view of how your investments are really performing. With it, you can:

Compare original projections to actual results across your portfolio

Track cash flow, distributions, and equity growth in one place

See how diversified you are across deals, markets, and sponsors

Spot trends and make informed decisions about future allocations

Stay organized with an easy, investor-friendly dashboard

Bonus Depreciation & the Recapture

This guide illustrates one of the most powerful tax advantages in multifamily and what happens when properties sell. Inside, you’ll learn:

How bonus depreciation works and why it creates large upfront tax savings

What depreciation recapture means at sale

Strategies like 1031 exchanges and the “Lazy 1031” to extend or defer tax benefits

Invest Smart Book

The Invest Smart Book gives you a proven framework to evaluate sponsors, spot red flags, and make confident investment decisions. Written by Gary Lipsky, it breaks down the complexities of multifamily syndications into clear, actionable steps. Inside, you’ll discover:

The most common red flags in deals—and how to avoid them

What true sponsor alignment looks like (and how to spot when it’s missing)

Why conservative underwriting and operational excellence matter most

Questions every investor should ask before wiring funds

A repeatable framework to help you invest with confidence

Just cover shipping and handling, and we’ll send the book straight to your door.

Investor Academy:

On-Demand Webinars

If you’d like to keep learning, explore our full library of educational videos on YouTube. Like and subscribe to stay up to date with our latest content.

If you’d like to talk through your goals and how we can support them, you can set up a time with our team using the button below.